WHY Beef Prices in Australia have skyrocketed, and the effect on beef dog treats.

Did you ever wonder why dog treat prices seem so high in Australia? We answer the question with actual current real-world analysis of the BEEF industry in Australia.

The reason why we do this is that The Australian dog treat industry (and dog food industry) that uses beef in its products has increased product prices substantially over the last decade. And its not the independent retailers who are making available single ingredient dog treats, that are making the extra profits.

Dog treat prices are directly tied to what the price of beef is in the retail market in Australia for human consumption.

At its most simple, if there is strong competition for a good, and there is a closed market (ie beef was used only for Australian consumption), then beef prices should be a simple supply and demand equation. If the supply and demand is steady, there should be little movement in prices. Just natural increased along with the rest of the products, as shown by the inflation rate or the CPI.

But that is not the case in Australia. Implicit in the supply demand calculation is the Beef Export industry – because if it is sizeable enough, it has the potential to reduce domestic supply and increase prices in Australia.

By the end of this article, you will understand more than most people how pricing filters down to the consumer, and most of the profit isn’t being made by the dog treat wholesalers (unless they own the cattle) or independent retailers. There is little vertical integration in the beef industry in Australia, so we (a retailer) as much as dog owners, are price takers. Or demand signals don’t have the same effect that it should have on end prices.

These are the main components affecting beef retail pricing in Australia and what we will briefly discuss:

• Australian BEEF production (AMOUNTS each year)

• Australian Population growth (and its effect on pricing)

• Australian meat consumption per person (takes into account human population increase)

• Retail cost of meat in Australia

• Price increases of ALL goods and products (CPI) V Food price increases, V beef price increases 2000 – 2023. Versus all major meat group price increases

• Australian meat exports (see tables below)

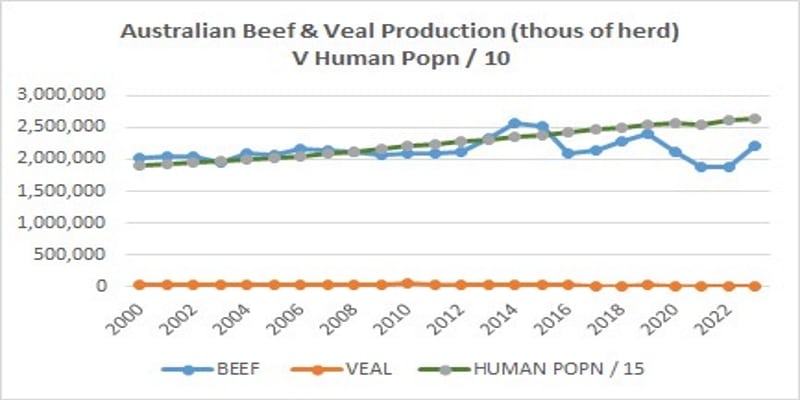

Australian BEEF PRODUCTION

| YEAR >>> | 2000 | 2005 | 2010 | 2015 | 2020 |

| BEEF | 2,018,507 | 2,062,519 | 2,080,958 | 2,513,898 | 2,102,854 |

| VEAL | 34,981 | 27,754 | 47,640 | 32,918 | 20,072 |

| HUMAN POPN / 10 | 1,902,880 | 2,017,684 | 2,203,175 | 2,381,599 | 2,574,379

|

If this was a closed system (only minor beef exports), then the increase in beef production would be an anomaly (since consumption in a whole country would rarely spike like this just for a single year). The increases could be caused by too many producers accidently having excess big herds (or droughts causing a sell off), or the dips could be due to bad one-off environmental conditions (like storms or fires causing herd losses).

One might wonder if with the increase of vegan advertising campaigns, by vegan commercial interests, it has reduced the beef consumption in Australia.

After all, about 12% of people claim to be vegetarian, and vegans are said to make up near 5% of the population in 2024.

TO understand why the beef production is so non-linear, let’s look at the history of beef consumption in Australia.

Domestic BEEF consumption in Australia

A recent MLA REPORT, says that “ There has been a steady decline in Australia’s per capita consumption of red meat over the past two decades. Despite this, Australia remains one of the world’s largest consumers of beef (7th), with per capita consumption in 2021 averaging 19.2kg (OECD-FAO).

The six countries consuming more beef per person than Australia are: Argentina, the US, Brazil, Israel, Chile and Kazakhstan.”

However, this decline seems to pretty much closely counter the increase in human population over the same time. (see the Australian population growth chart previously). That would mean that the production of beef should remain approximately constant for domestic consumption, to feed an increasing population that overall has a declining beef consumption per person. BUT this assumes that exports are either negligible or not increasing significantly. You will soon see that exports are a LARGE factor in producer pricing.

The first major bump in beef consumption (see graph) seems to coincide with the 2014 start of the decline in ‘consumption of beef’ per person in Australia. With this information alone, the data doesn’t make sense, without either an export anomaly, hidden massive production increases (for one year) or beef producers artificially charging more.

This is when its important to look at what amount of food is ‘leaking’ out of Australia (exports). And if the amount is large enough to account for the bumps in beef production.

“Australia’s per capita beef and sheep-meat consumption continues to be one of the largest in the world. 92% of Australian households purchased beef and 72% bought lamb in the past year.” MLA

By 2023 MLA calculated that Australia’s consumption of beef had increased again. “Australia remains one of the world’s largest consumers of beef, ranked third behind Argentina and the United States, with per capita consumption in 2023 averaging 23.4kg.” MLA

“ 2024 set to break production and slaughter records highlighted in their 2023 analysis, ” MLA

If there were no exports, the declining beef consumption per capita would be of great concern to producers. However with robust export industries, it appears that this theory might be the other way around. That is, with strong export industries, perhaps the producers are artificially increasing Domestic beef prices, knowing that it’s a staple food group that most people will buy at any cost (like petrol or utilities).

And perhaps, the decline in per person beef consumption is not a choice, but caused by the increase in beef prices itself. If this is the case, then these actions are unconscionable or in the least very questionable. Something that requires government intervention, and new laws.

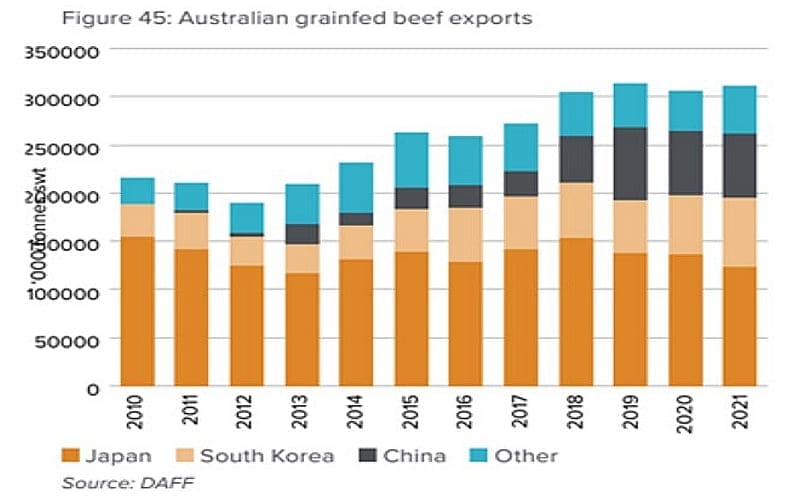

Australian BEEF exports

The graph and tables below from the MLA, show how beef exports have changed over time and who the major import countries are. Japan has always been the biggest importer of Australian beef, but as you can see China is rapidly increasing its share.

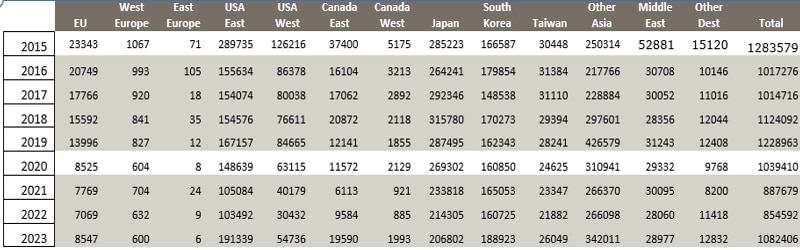

BEEF AND VEAL EXPORTS from Australia

The original question we had above, was what was causing the bumps in beef production in Australia in 2014 and 2019 and are beef exports sizeable enough to affect beef prices in Australia.

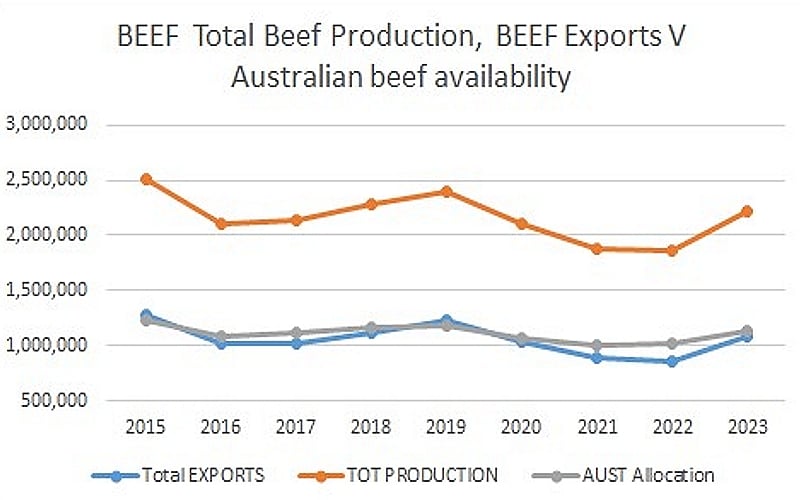

The table and graph compare total Beef Production 2015 to 2023, Total beef exports, and what is left over for Australian domestic Beef consumption (human and dog).

Beef Total production, exports and domestic consumption 2015- 2023

| YEAR | Total BEEF EXPORTS | TOT BEEF PRODUCTION | AUST Available | % Aust. / TOT PROD |

| 2015 | 1,283,579 | 2,513,898 | 1,230,319 | 48.9% |

| 2016 | 1,017,276 | 2,100,851 | 1,083,575 | 51.6% |

| 2017 | 1,014,716 | 2,130,216 | 1,115,500 | 52.4% |

| 2018 | 1,124,092 | 2,289,221 | 1,165,129 | 50.9% |

| 2019 | 1,228,963 | 2,403,960 | 1,174,997 | 48.9% |

| 2020 | 1,039,410 | 2,102,854 | 1,063,444 | 50.6% |

| 2021 | 887,679 | 1,883,275 | 995,596 | 52.9% |

| 2022 | 854,592 | 1,868,988 | 1,014,396 | 54.3% |

| 2023 | 1,082,406 | 2,210,956 | 1,128,550 | 51.0% |

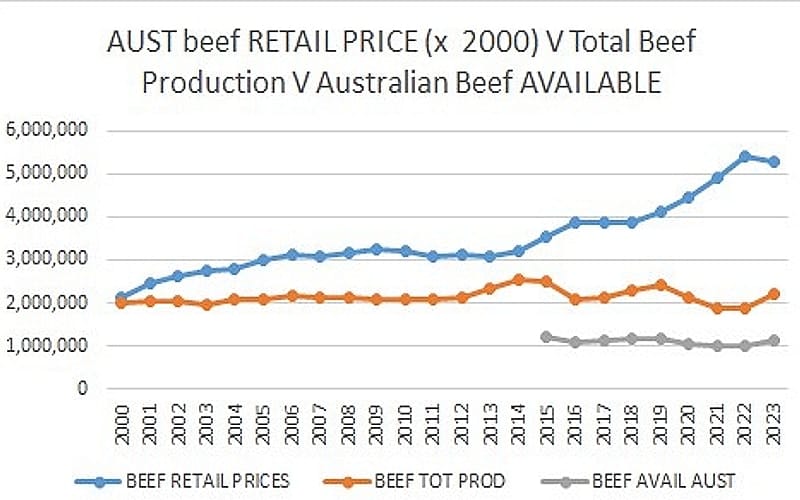

You can see from the graph that the Australian beef allocation is hovering around 50% of total production of been for the last 8 years. This suggests that exports have the potential to have a massive effect on beef prices in Australia.

The ABS SAYS “Australia plays a key role in the global supply of meat, particularly beef and sheep. Australia was the 4th largest exporter of beef in 2022, and supplied 50% of global sheep meat in 2023 . Forecasts suggest Australia could become the second largest exporter of beef in 2024 . Weather and other factors play a key role in Australia’s meat production and exports. “ (ABS)

You will also see that the bump in 2019 for total beef production, coincides with the increase in beef exports for that year. The comparisons of total exports, and Total Australian beef consumption graphs shows that export amount changes each year are very correlated with total production amounts. The Australian total beef available amounts is relatively stable.

All things being equal, it suggests that an increase in exports during even within one year have a possibility of significantly affecting Australian retail prices.

THE MLA SAYS “ Red meat and livestock export value rose 3% year-on-year to total $18.2 billion in 2022–23. In 2022–23, the value of chilled and frozen meat accounted for nearly 83% of total meat and livestock exports at $14.7 billion, with live sheep and cattle exports accounting for 7% at $1.3 billion. Co-products and further processed exports accounted for the other 10%, valued at $1.7 billion.” MLA

In calendar year 2023, Australia was the second largest beef exporter and the world’s largest sheep-meat and goatmeat exporter.

“In 2023, Australian beef and veal exports totalled 1.08 million tonnes shipped weight (swt), up 27% year-on-year. The United States emerged as Australia’s largest beef export market (in volume terms) in 2023, totaling 246,000 tonnes.” (MLA)

AUSTRALIAN BEEF RETAIL PRICING

As you can see from the MLA organisation graph above, the RETAIL price of beef in Australia has had two rapid price increase periods. From 2001 to 2006. And from 2014 to 2020 (short beak in 2016- 2018).

But again, natural disasters or beef company mergers might have an affect on that pricing. To see if RETAIL pricing has been caused by the total beef production in Australia decreasing, OR the total amount of beef available to Australians (about 50% of the total), we created the table and graphs below.

Australian Beef Retail Prices Versus TOTAL Australian Beef Production V Australian beef consumption

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| BEEF RETAIL PRICES | 1,762 | 1,926 | 1,927 | 1,942 | 2,064 | 2,230 | 2,457 | 2,699 | 2,637 |

| BEEF TOT PROD | 2,513,898 | 2,100,851 | 2,130,216 | 2,289,221 | 2,403,960 | 2,102,854 | 1,883,275 | 1,868,988 | 2,210,956 |

| BEEF AVAIL AUST | 1,230,319 | 1,083,575 | 1,115,500 | 1,165,129 | 1,174,997 | 1,063,444 | 995,596 | 1,014,396 | 1,128,550 |

Since the consumption of beef per person has been slowly decreasing over the last decade and the total production of beef has remained relatively constant (except for the bumps mostly caused by export), you would think that the retail price has little to do with Australian retail Demand (how much beef we buy at stores).

However, as many people are aware, the biggest economic issue in Australia since the pandemic is the so called “cost of living crisis”. This is where there have been high price increases across all goods and serves, and absolute wage values have stalled.

This might have you think that price in creases of beef might solely be due to the ‘rising tide’ of all goods sold in Australia.

Things like increased logistic prices, increased utility prices.

The last thing to check is how the price of beef compares with other price increases in Australia. If beef price increases are the same as similar goods, then its external factors outside of the industry that are causing the prices.

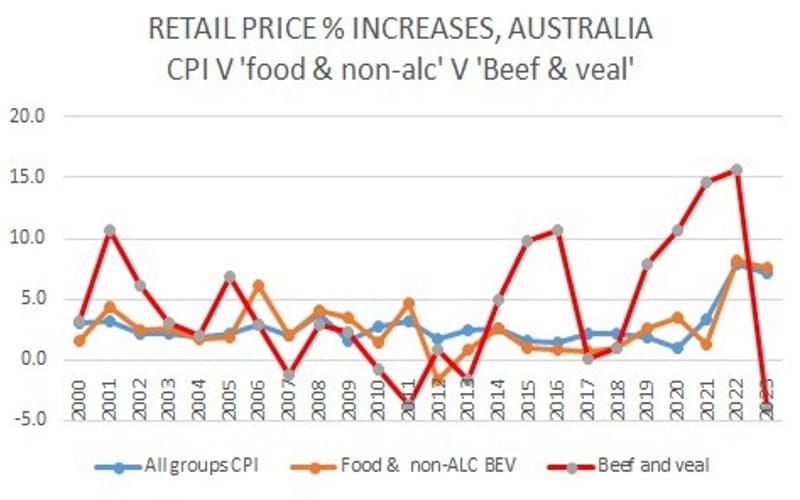

Beef retail price increases compared to CPI and ALL FOOD prices

These statistics are drawn from ABS data. That means there is no commercial bias to what you see.

We have compared three of the most important measures of price increase, to see if the increases in Beef prices (RED) in Australia are inline with CPI or the general food increases since 2000.

The BLUE line represents (all Groups CPI). It is the total Australian CPI (consumer price index) % price increase per year from 2000 to 2023.

As CPI is the average Price increase of ALL goods and services in Australia, this means that if the average increases were the same as the median, then about half of the goods and services would have had less price increases in any one year, and half would have had greater price increases.

You can see that the CPI is relatively constant except for 2020 to 2023 increase. But even then, the price of beef (retail) is still about DOUBLE that of the CPI.

For completeness we compare beef retail price increases to the overall “food and Non-alcoholic beverage) Price increases (ORANGE LINE) over the same period as the CPI was measured (yr 2000 to 2023).

The ABS data shows that this ORANGE line in the graph is a little more volatile than the CPI value, as expected, however it is also relatively closely correlated with where the CPI values track except three times over 20 years does it peak above 5%.

And now the big puzzle directly related to this beef report.

The beef and veal price increases have been VERY VOLATILE. In three recent years it has peaked over a 10% average increase for the year, and it has seemingly no correlation with the CPI prices OR the food and non-alcoholic beverages’ group (that it is a sub part of).

2016 and 2022 are the two biggest retail beef price spikes in Australia.

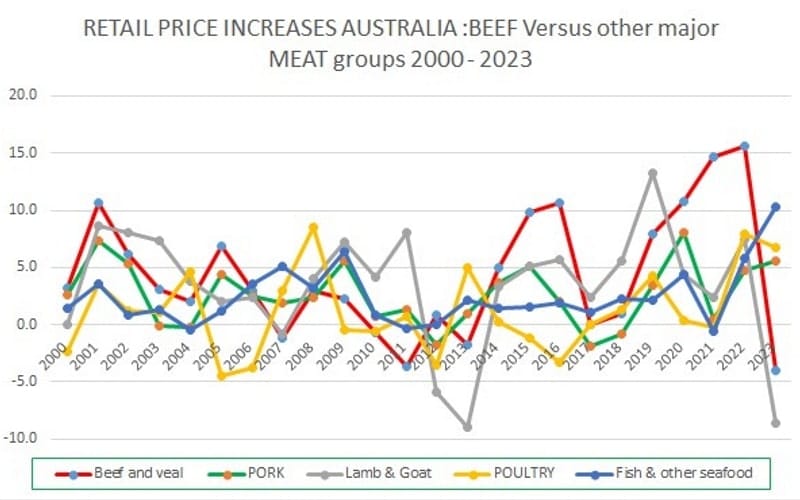

Comparing BEEF Retail price increases in Australia with all other major MEAT GROUPS

The true comparison for Beef increases In Australia is against ALL other individual meat groups. This way will give us insights into how much the price increases have to do with common fixed costs like logistics and feed costs, Versus industry specific costs (ie the beef industry) related to either the profits of an industry or even how much meat is exported.

The above graph shows, conclusively that BEEF in Australia since 2014 has had the highest price increases against any meat group except Lamb and Goat.

The thing to remember here is that these graphs are yearly averaged retail price increases. That means that their price increase effect is CUMULATIVE. Because BEEF has had such massive price increases, for example 2014 at 5%, AND 2015 and 2016 both over 10%, then the absolute prices of beef were already far ahead of other meats.

Beef in 2019 to 2022 had FOUR YEARS of near or over 10% price increases EACH YEAR. One year of price correction in 2023 when there was a drop of near 5% means very little coming off such previous massive price increases.

You would think that the PORK industry or Poultry industries would suffer similar external price increases causing their products to have similar price increases as BEEF. Yet both Pork and Poultry have price increases that are dwarfed by the upward spiral of Beef price increases.

The only meat group listed by the ABS data that has anywhere near similar massive price increases has been the LAMB AND GOAT RETAIL Prices. That industry had a negative correction in 2012 and 2013, however previous to those years, LAMB & Goat has tended to be near the top of the price increases (as had beef) and again since 2014 to 2019 its price increases were second only to Beef.

All meat products had a negative price correction in 2021 during the pandemic. A year that exports were restricted.

What makes Lamb & Goat industries AND beef industries have such positive price increases above all other meat industries?

This is hypothesis only, because pricing is a company and industry secret. But from the ABS report we know that “Australia plays a key role in the global supply of meat, particularly beef and sheep. Australia was the 4th largest exporter of beef in 2022, and supplied 50% of global sheep meat in 2023 . Forecasts suggest Australia could become the second largest exporter of beef in 2024.”

It would appear that unregulated export of Beef, lamb and goat from Australia has led to massive RETAIL price increases to the Australian people, and prohibitive costs of these meats in Dog treats.

Dog food also will suffer from high price increases but not as much, since dog food typically only has 30- 40% meat and MDM (mechanically deboned meat). MDM is meat shredded off-the-bone, NOT prime cuts of whole meat, like we provide in most of our dog treats.

CONCLUSIONS

Our Total beef production has stayed relatively constant over the last 20 years except for a couple of bumps. But the rising Australian population seems almost balanced with the decrease in beef consumption per person, to keep the total beef demand of the domestic market constant.

The only thing not accounted for in this supply demand equation is the amount beef export that domestic producers are doing.

While beef exports have remained relatively constant over the last decade, they do account for near 50% of our total beef production. So they have the potential to have a major effect on Australian Retail prices.

Coupled with this, the major export partners tend to have much larger populations than Australia and have high living standards suggesting relatively high disposable income for their citizens who want to eat our meat products.

This would suggest that their people have the propensity to pay more for beef than Australian residents do (particularly with the relatively high (globally) housing costs for Australians).

Other clues about retail beef pricing in Australia can be found here:

In sep 2024 “MLA’s Managing Director Michael Crowley, (said) 2023 was a year where the industry remained resilient despite volatility. “Following three years of consistent growth, the red meat sector moved into a period of change, with 2023’s turn off resulting in peak production and slaughter numbers across beef cattle, sheep and goats,” Mr Crowley said.

“However, weather conditions deteriorating in much of the country and a simultaneous declaration of an El Niño and Positive Indian Ocean Dipole (IOD) triggered a significant sap in confidence in the industry, pushing prices to concerning lows in the second half of last year. The industry was able to remain resilient in the face of this instability thanks to strong demand across a diversifying export market and strength in the processing sector.” MLA

If Australia is bumping up against “peak beef production” then relatively low herd sizes could artificially increase prices in the domestic market further, more so than the export market that has bigger competition. TOTAL Beef Herd sizes are typically around 28 million head of cattle and the EXPORT market is around $5 billion. Plus $600M live exports.

For meat retailers to charge higher prices for beef in Australia, the assumption is that either supermarkets are keeping the prices artificially high (duopoly) – or wholesalers are making a higher profit, or retail demand in Australia (despite decreasing per capita consumption of beef) is pushing the prices higher. But according to the rising Vegetarian movement, demand should naturally be suppressed in Australia, and not driving prices up !

The concern is, that if 50% of our beef is being sent overseas, and is getting higher prices, then that would make Australian beef processors “price setters” in Australia. That is, they are working artificially outside of regular supply demand economics. Those theories also suggest that there are main market players (beef producers) competing to sell their products in Australia. Is that true?

Well, of the 40,000 BEEF producers in Australia, many are small capacity. PWC says “Northern cattle producers account for 75% of farming land in Australia dedicated to beef. Despite this they account for just under half of the national herd. Cattle in the northern region typically forage for feed over sprawling properties” Much of this cattle is lower quality compared to southern beef .. (and so the) northern area targets the Asian market through live exports.” PWC

“Farms in southern areas (of Australia) are generally more intensive than their northern counterparts. (they) run European and British breeds which are kept for their ability to gain weight and produce favourable quality meat. … this cattle is typically sold into high value markets. These include; Korea, Russia and Japan.” PWC

Due to the complexity of the producer mix and export markets pricing you might almost think that a food security legislation should be created to ensure that Australian residents (and their dogs food source) to ensure we both have access to AFFORDABLE meat grown in Australia. Without such protections, or legislation of domestic food prices, the Australian people are likely to see greater volatility (increases) in meat prices (and NOT because meat isn’t being produced or because of rising costs of production – just compare beef price rises to the other main meats that are not exported).

There is a strong argument that meat should be freely available for ALL people in Australia to buy, at a reasonable price. It is one of the best sources of animal protein and many other nutrients. We and our dogs shouldn’t all have to become vegetarians because of an artificial cost issue, rather than any supposed ‘ethical’ issue.

ABOUT MEAT DOG TREATS IN AUSTRALIA

Beef Jerky dog treats in Australia are often made from the cow trachea. And that is often because people don’t want to eat trachea, and its not such a prized export. That is fine, but it’s a lower quality ‘meat’ that is still sold at a relatively high price (because of the high export of beef muscle meat leave high competition for what’s left over).

However, we (Healthy Dog Treats) currently (2024) sell a Beef Jerky Pieces that are 100% Aust. beef Muscle Meat and ‘Beef Jerky Prime’ (actual steak cut).

As far as Lamb and Goat goes, you will see from this report that it’s the second most exported meat groups from Australia, hence perhaps the reason why Lamb prices have increased so much in the retail human food market. And also, the reason you will rarely find anyone supplying lamb meat (single ingredient) dog treats, Or, why Goat treats are so expensive.

It is now probably a good time to echo the term used in politics in Australia a few years ago. A ‘banana republic’ is a small (country) that is unstable (or has artificially high prices) … as a result of the domination of its economy by a single export controlled by foreign capital.” Or in this case, main meat groups exported for foreign capital, for individual company profits.

You can see from this report that beef price increases in Australia have been much higher than the CPI or the food group price increases in General. And that effects the people and dogs of that country in their ability to afford to buy that meat. Food prices are a massive cause of the ‘cost of living crisis’ and unregulated exports are clearly not helping.

YOU can see that with a large export market that is becoming more attractive to local Australian meat producers, that there is potential to have a smaller amount of meat available for the domestic local Australian market.

These factors directly affect the cost of production of beef dog treats in Australia. (and lamb, goat, or any other meat that is highly exported or a company has high exports).

All we can do is source the best quality dog treats are affordable prices for the dogs of Australia. And at least now you might have greater insight into the price pressures the independent dog treat retailers are under to continue our good work !

REFERENCES

1 ABS data

2 STATE OF THE INDUSTRY REPORT The Australian red meat and livestock industry. BY Meat and Livestock Australia (MLA ) 2022